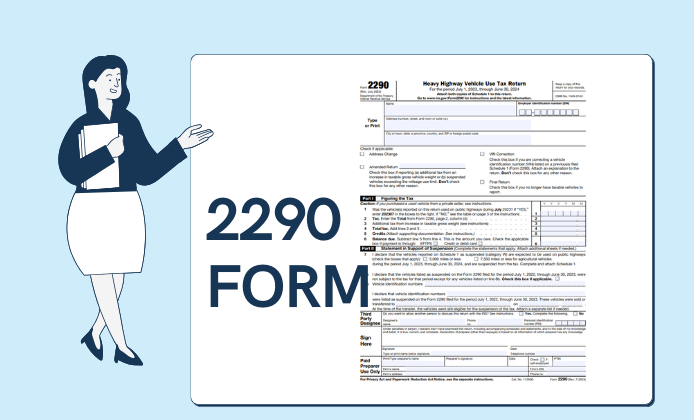

The IRS 2290 tax form is a primary tool that ensures your taxes are clear as a truck owner or operator. It is a document you submit to the United States Internal Revenue Service (IRS) annually. This submission aims to calculate the federal tax you owe on the utilization of heavy highway vehicles.

Now, look at some vital fields you should know when filling out the IRS 2290 tax form printable in 2023. It is essential to provide the correct information in these fields. These include the vehicle owner's name, address, and Employee Identification Number (EIN). Other fields capture information on the taxable gross weight, vehicle identification number (VIN), and the tax amount due.

Filling out the 2290 Printable Form Properly

Completing your 2290 printable tax form is simple if you follow these steps:

- Begin by entering your EIN, name, and address in the appropriate fields.

- On the second part of the form, capture details of your heavy vehicle, including weight, VIN, and date it was first used on public highways.

- Calculate the tax you owe using the tax computation section of the form.

- If your vehicle is used for less than 5,000 miles, you may be exempted from paying the tax. Indicate this on the form.

- Finally, certify your form by signing and dating it.

Submitting Printable Form 2290 (HVUT)

After accurately completing your printable Form 2290 (HVUT), the next step is to submit it. You can mail it or file it online.

For mailing, send the filled-out IRS 2290 printable form with the full tax payment due. To file online, visit the IRS site and use the IRS e-file system. You must create an account and then submit the form and your payment. Ensure you furnish all the needed details accurately to avoid unnecessary delay.

Upon successful submission, you will receive a stamped Schedule 1 copy. This is your proof of HVUT payment. It is advisable to keep this document safe for future reference.

Time Frame – Don’t Miss the Deadline!

It is crucial to submit your free printable 2290 form for 2023 within the given time frame to avoid penalties. The tax period begins on July 1st and ends on June 30th of the following year. However, the due date for filing IRS Form 2290 is August 31st. If, for some reason, the deadline falls on a weekend or a public holiday, the due date will be the next business day.

It pays to be punctual with your tax filings. This guide will help you complete your IRS Form 2290 filing. Remember, keeping our highways safe is both a legal and social responsibility, and so is paying our due taxes!

Printable Form 2290 (HVUT)

Printable Form 2290 (HVUT)

Form 2290 for Online Filing

Form 2290 for Online Filing