Are you familiar with Heavy Use Tax Form 2290 (HVUT)? Let's take a quick swim into what it is. This document, officially known as IRS Form 2290 for 2023, is a crucial instrument for all truck owners driving heavyweight vehicles on public highways. It's required by the IRS to figure out and pay the yearly tax due for your substantial load-carrying vehicles.

However, filing this form can feel overwhelming. Don't worry; that's where our website, form2290us.com, steps in to make your life simpler. Our website provides easy-to-understand guidance and a systematic sequence of steps for filling out your blank 2290 form for print. Loaded with detailed instructions and relatable examples, this platform aims to streamline your filing experience. By using our resources properly, you can avoid common mistakes and have a smoother tax journey. We're committed to helping you fulfill your fiscal obligations the right way!

The Tax Form 2290 Instructions Summary

If you own a heavy highway vehicle with a taxable gross weight of 55,000 pounds or more, you need to fill out the 2290 form online. This tax return calculates and pays the due related to these vehicles. But there's no need to worry if it sounds complex, as we're here to help.

There are a few exceptions related to Heavy Highway Tax Form 2290, where you wouldn't need to file it.

- For instance, if your vehicle isn't considered a highway motor vehicle - like mobile machinery for non-transportation functions, certain non-transportation trailers and semi-trailers, or if it's a vehicle registered by a state as specially designed for off-highway use.

- Moreover, vehicles not exceeding 5,000 miles (7,500 for agricultural vehicles) during the tax period are also exempted.

To make it easy for you, we offer a printable Form 2290 for 2023 that you can download from our website. This will help you to file your tax return more efficiently. You're not alone in this. We're here to guide you every step of the way.

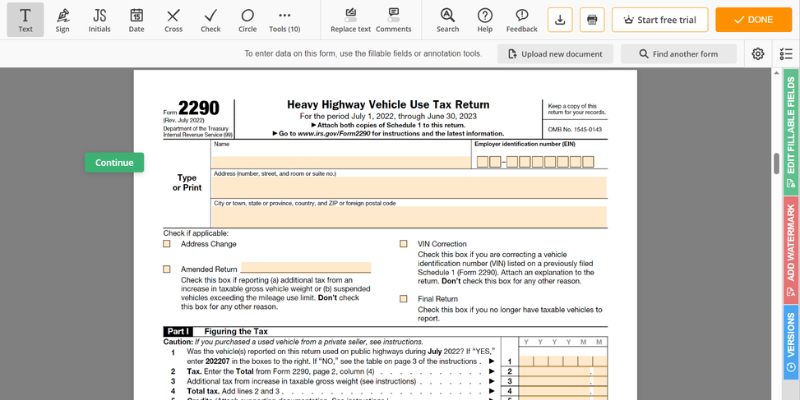

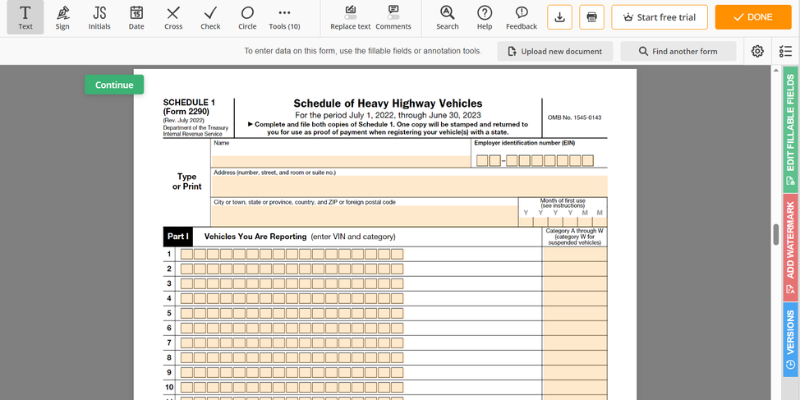

IRS Form 2290 for Tax Return: Steps to Fill Out the Blank Template

Here are step-by-step instructions to guide you through the process of filling out IRS Form 2290 for 2023 without any errors.

- First, fetch the IRS 2290 tax form in PDF format from our website. It's not just for viewing; you'll find it's printable and fillable. So, you can download it, print and fill it out at your convenience.

- Your next step involves a series of information to be filled. Begin with your name and address, then the tax year and the VIN (Vehicle Identification Number). Don't forget the gross taxable weight and date the vehicle was first used on public highways.

- Now, one might wonder where to find these details. The answer is simple. You can easily locate all required information using the Form 2290 instructions for 2023, available on our website. These instructions are plain, precise, and particularly useful for first-time filers or those needing a refresher.

- Lastly, double-check all your inputs to make sure all figures tally correctly. We aim to ease your journey toward IRS Form 2290 printable for 2023 so you can pay your HVUT effortlessly.

The IRS Form 2290 Due Dates

The deadline to file Form 2290 online is August 31. Why this day? Our taxation system sets this date because August 31 marks the end of the tax form's 12-month period. It's arranged this way to align with the Federal Government's fiscal year, which starts on July 1 and ends on June 30.

One common question is whether you can get more time to send in the paperwork after the deadline. However, there's no provision to apply for an extension for completing printable IRS Form 2290 in 2023. So, keep track of the due date because late filing can result in penalties.

IRS Form 2290 Instructions for 2023

IRS Form 2290 Instructions for 2023

Federal Form 2290 (FAQ)

Federal Form 2290 (FAQ)

Tax Form 2290 Due Date

Tax Form 2290 Due Date

Printable Form 2290 (HVUT)

Printable Form 2290 (HVUT)

Form 2290 for Online Filing

Form 2290 for Online Filing